30/05/2025

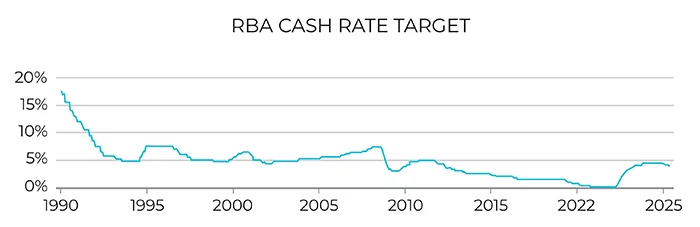

Dozens of banks have responded to the Reserve Bank of Australia’s recent decision to reduce the cash rate from 4.10% to 3.85% by cutting interest rates for their variable-rate loans.

While the size and timing of the cuts varies from lender to lender, the trend is clear – most variable-rate borrowers are already seeing or will soon see their monthly repayments fall.

For a borrower with $500,000 outstanding on their home loan and 25 years remaining in their term, a rate cut of 0.25 percentage points means savings of about $75 per month or $900 per year. Please note these are rough estimates; actual savings will depend on your loan size, remaining term and interest rate.

The bottom line is that if you currently have a mortgage, you may be able to unlock meaningful savings by refinancing with a lender offering a lower rate – even if you had a competitive interest rate when you took out your loan.

Contact me to find out how much you might be able to save by switching home loans.