Australian mortgage repayments have nearly doubled over the past decade – rising from an average of $2,214 a month in June 2015 to $4,383 in June 2025, according to a Mozo analysis of Australian Bureau of Statistics data and Mozo home loans data. That extra $2,169 equates to about $71 more every day for the average borrower.

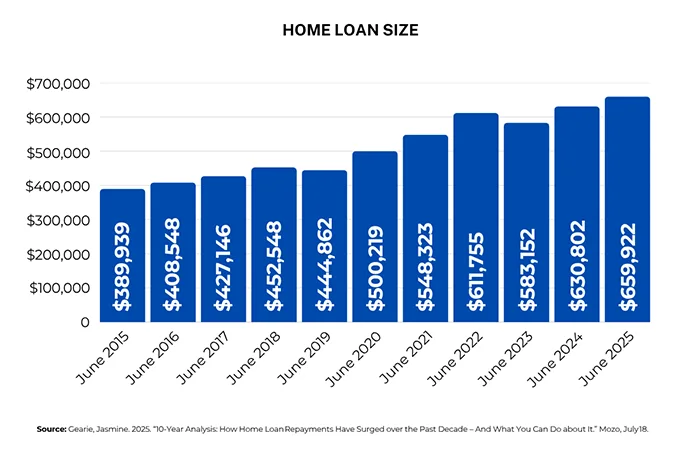

Loan sizes have ballooned too – up 69%, from $389,939 in 2015 to $659,922 in 2025 – driven largely by soaring property prices and higher interest rates.

On the bright side, the savings from switching lenders have also more than doubled. Mozo found borrowers could save up to $373 a month by moving from an average rate to the lowest available today, compared to just $180 in 2015. That adds up to almost $4,500 in the first year alone.

In my experience, many lenders don’t pass on rate cuts in full – and some borrowers are still paying well above market rates without realising it. That’s why reviewing your loan regularly is so important. With access to a wide panel of lenders, I can help you find a more competitive rate and guide you through the refinancing process.

If you haven’t reviewed your home loan recently, now might be the ideal time to compare your options.