If you’re thinking about buying a property this year, it’s a good idea to secure a home loan pre-approval before you start your search. Due to the challenging interest rate and inflationary environment, some people have less borrowing power than in previous years. Once you know how much you can borrow, you’ll know the maximum price you can afford to pay for a property.

Before you start home-hunting, I recommend you look for opportunities to increase your savings. This can be done through a combination of reducing your discretionary spending and increasing your income (by asking for a raise, doing more hours or starting a side hustle). So when you apply for your pre-approval, lenders will see you have a greater capacity to repay a loan, which should increase your borrowing capacity.

I also recommend you contact me to arrange a copy of your credit report, which we offer as a free service. If you find any errors, you can contact the credit provider and ask them to fix the mistakes. Otherwise, they may unfairly drag down your credit score.

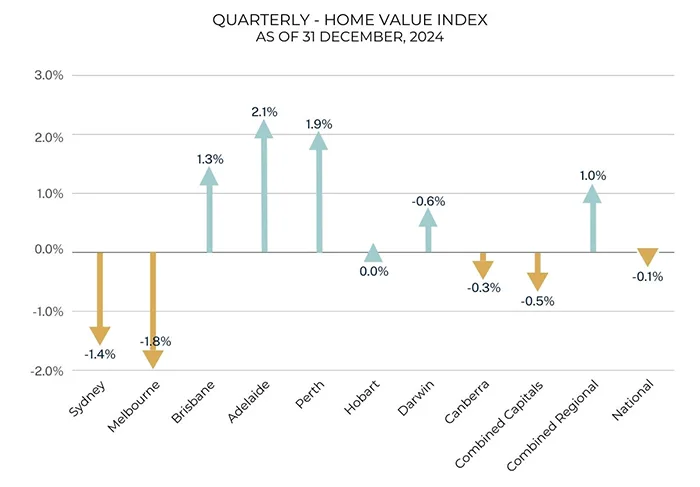

When you do start looking for a property, take the time to understand local market conditions. If prices are rising, that means buyer competition will be quite strong, which will limit your negotiating power. But if prices are falling – as they currently are in many markets – you may be able to drive a harder bargain with vendors.