How have borrowers coped with higher interest rates and inflation over the past three years? Very well, based on the most recent Financial Stability Review from the Reserve Bank of Australia (RBA).

“Despite widespread pressures on households’ budgets, most borrowers have enough income to cover their essential expenses and scheduled mortgage repayments,” the RBA said.

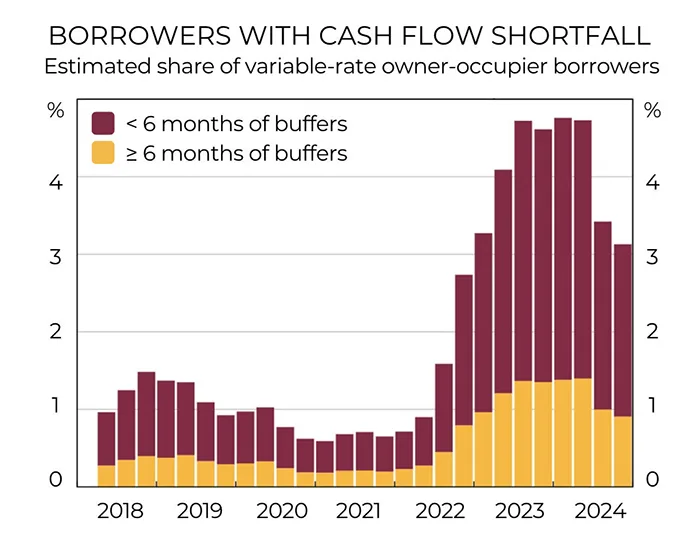

“Around 3% of borrowers are currently estimated to be experiencing a ‘cash flow shortfall’, putting them at risk of falling behind on their loan repayments. Although this percentage is higher than before the pandemic, it is notably lower than the peak observed prior to the Stage 3 tax cuts and a further moderation in inflation over the second half of 2024.”

Furthermore, the RBA said only about 1% of all variable-rate owner-occupier borrowers had both a cash flow shortfall and minimal financial buffers, which meant very few borrowers were at a high risk of falling behind on their mortgage.

“Additionally, the share of loans in formal hardship arrangements has stabilised, although it remains a little higher than pre-pandemic levels.”

Most lenders have hardship programs for borrowers who are struggling to pay their home loan. Please contact me if you’re experiencing financial difficulties.